Online payment has become a prime necessity associated with e-commerce and the online world in general, as it constitutes the core pillar on which all financial transactions rely in the virtual world in any field whatsoever.

In fact, the value of online payment transactions in 2016 has exceeded 35 billion dollars in the Middle East, and in 2018 the user acceptance rate of online payment has reached 71% in the Arab Emirates and 58% in Saudi Arabia and it has become more used than paper money.

Sale and purchase transactions and commercial activities cannot be completed without an online method of payment. Therefore, the idea of providing a secure method for the exchange of money came up, which is precisely through online payment.

A customer will not benefit from completing sale or purchase transactions if his/her money still depends on paper-based transactions.

It is also evident that the customer requires privacy and security when it comes to his/her money, bank account information and personal information.

By definition, online payment is a set of integrated systems and techniques provided by banking and financial institutions and banks in order to offer a secure method for payment and collection and for completing financial transactions of all kinds.

In other words, online payment represents employing technology, internet and smart systems to collect payments, facilitate sale and purchase transactions, and regulate monetary transactions between different parties and in different countries around the world, with the least amount of effort and in the shortest time.

Online payment is the tool associated with all online commercial activities, which consist of the sale and purchase of goods, products, services, training sessions, online products and other purchases that are completed online, whether by paper money through bank accounts or by the newly prevalent digital money.

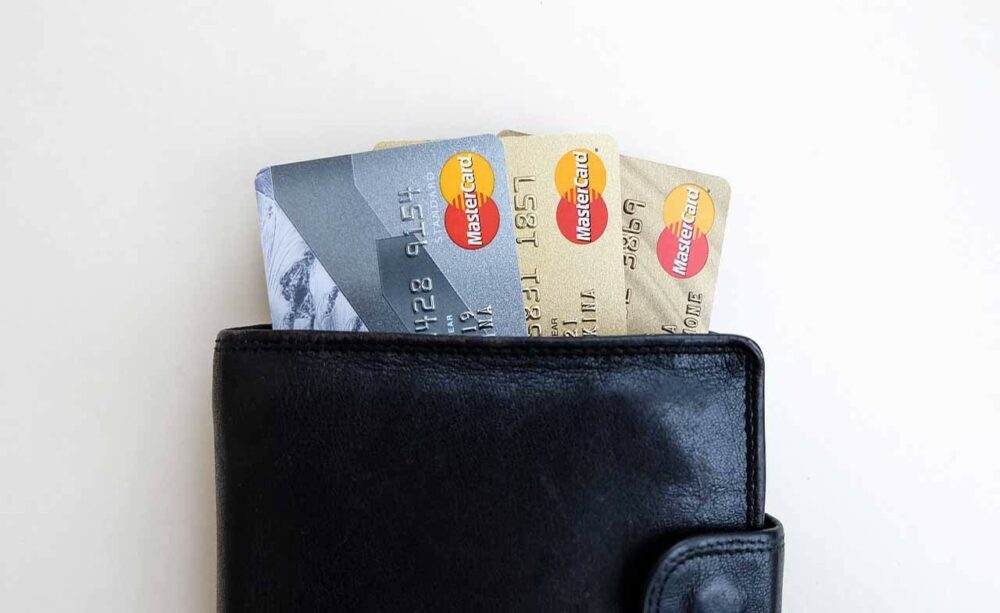

A prepaid card is a card that is affiliated to an international or local bank and is given in return for the deposit of a certain amount of money at the bank. It can be used for purchases through a deferred balance that will be settled later by the bank according to the balance of this card, or through the pledge of an amount that will be settled later by the cardholder.

In other words, it is a tool that places the bank as an intermediary for the sale and purchase of products and goods without the need to carry large sums of money, according to an agreement or contract or deposit or transfer through international payment gateways.

There are multiple types of prepaid cards:

It is the oldest one among all online payment means and it is safer than carrying money while traveling and even in markets. This is why it has been very popular, has been widely used by customers and is still effective to this day.

It is a metallic or plastic card including a cipher and containing a particular code that is specific to the bank to which it is affiliated. Just by swiping the card through a specific device, the users are able to spend and pay with the card up until the depletion of the amount deposited at the bank.

They are similar to credit cards in their system, but they require the existence of a balance for the card. Which means that you cannot make a purchase through a deferred amount and pay it later as you can with credit cards that are based on a contract between the bank and the cardholder.

These cards are usually used on a smaller scale than credit cards. They are also secure, fast, and easy to use, but they are linked to a specific account number without which they cannot be used, and the amount is also directly debited from the bank.

They are also quite similar to both previously mentioned cards, but they are characterized by the possibility to store user data since you will be able to know the name and all required data of the user simply by inserting the card in the specific operating devices.

Large company and business owners and top traders tend to possess such cards. These cards are also secure to a certain extent but are not more secure than the others.

They are the most widely used nowadays when it comes to completing online payments as they do not waste time and are very dynamic for online stores.

Bank accounts and websites:

They represent one of the main online payment methods that are widely used in the fields of online marketing, and they are special, secure and easy to use. They have the same basis as credit cards but without a card. These accounts are managed online through applications, where the accountholder can access his/her account from any device by entering the required data such as the username or email and the password.

It is possible to make online payments through these accounts by transferring an amount of money directly from the buyer’s account to the seller’s account without any paper-based transactions or any waste of time or effort.

They also execute online payments smoothly but are sort of outdated and are the least used. The customer can communicate with the bank and transfer a certain amount of money from his/her account to another account at the same bank or at another bank to complete a purchase or to pay his/her dues.

Online payments using this method are sort of restricted because they depend on the opening hours of the bank and on its connections, but they generally serve the purpose.

They represent an international method to complete online payments and also offline ones. They enable the customer to pay and collect payments by transferring them from one account to another, allow the collection of payments and money easily, and are spread throughout the world.

They are exactly similar to paper checks but are electronic and are dedicated for online payments. The e-check is a part of online commercial transactions.

The e-check is 90% cheaper than a paper check, as a paper check costs one dollar whereas an e-check costs 0.10 dollars. It is also more secure than paper checks for those who prefer dealing with checks in general.

Online payment is provided by a number of companies like Fatora, the number one payment gateway in Qatar, that offers a large collection of facilities and features that get you to certainly choose it such as:

Online payment methods:

It is the latest development in the virtual domain and the world of e-commerce, and it represents digital currencies that do not have a balance in reality and can be obtained through a process called mining. Digital currencies have become very popular nowadays and the most well-known among them is Bitcoin.

kanchanara Lta5b8mPytw unsplash

It is an online application that is managed through smart devices such as a mobile phone or an iPad, and it provides a high level of security such as fingerprints, two-factor authentication and facial recognition systems, in addition to passwords which are used with the previously mentioned cards. It is a tool that is available around the clock for online payment. The most well-known e-wallets are PayPal, Google Pay and Apple Pay.

It has been previously detailed above and is one of the payment methods that completes online payments.

Online payment with Fatora:

Receiving and sending international and local payments through various methods including: Visa Card, PayPal, American Express.

Issuing invoices: Fatora offers the chance to issue invoices that are specific to the customer and consistent with his/her trademark. This feature has the advantage of increasing personalization and offering better customer trust.

Legal dealings that guarantee the rights of both parties and facilitate financial transactions between them.

Linking the online payment gateway to applications, websites and accounts, such as linking it to an online store.

Sending the invoice links through any chosen means, such as email, direct text messages, Facebook, WhatsApp, Instagram.

Secure transactions and high-security protection of customer privacy.

Collection of payments through various methods.

You can collect your payments online with ease and high efficiency with Fatora, the fastest and easiest service by the number one payment gateway in Qatar. We offer you a special service with high reliability, transparency and confidentiality to safeguard the privacy of your transactions.

Online payment for online stores with Fatora:

In addition to creating an online store for free on the Fatora website, you can also link your online store with several links, such as the link to your social media accounts and the link to the online payment gateway that offers you online payment through different local and international methods.

You can also create an integral store that supports all the languages you want and also supports smart devices and connectivity with their applications. Thus, you can complete online payment transactions with your mobile phone without any inconvenience or any waste of time and effort.

Fatora also offers you multiple options to create your invoice, as you can create a simple invoice for simple and fast transactions such as the sale of a product.

You can create detailed invoices in the event you purchase a large amount of goods in installments, in order to facilitate the collection of your money and the development of your business and of your online store.

There is also the subscriptions invoice which was designed specifically for the providers of training sessions and owners of educational centers; it is an invoice for the payment of periodic subscriptions. If you are the owner of a club or training center, then this type of invoice was conceived especially for you.

Fatora has also added the Cashier POS Service to its application. This service provides sales centers that facilitate the collection of money and dues; you only need to include points of sale in your online store in order to collect your money.

Also read: Fatora 101 Guide

It is the step that puts in your hands the easiest tool for managing your financial transactions, store and application, as the Fatora application has the great ability to simplify the processes of management of all the tools that you need.

Through this application, you can manage your bank accounts and pay your financial dues from any place in the world by linking them to the number one payment gateway in Qatar: the online payment gateway by Fatora.

You can also collect your money through various methods including issuing exclusive invoices for yourself or for your store if you are an online store owner, or you can issue subscriptions invoices as previously mentioned.

You can also manage and develop your store, add features, and improve its appearance, all this and much more through the Fatora application.

In order to enjoy online payment and all features of the Fatora website, and to benefit from all the new features and access all offers, you need to stay in direct contact with the website by registering your personal account on the Fatora website, through which you can archive your information and invoices, organize your payments and financial dues, and manage all your transactions without the need for an accountant or employee.

You will find on the homepage of the Fatora website the online payment gateway button. By logging in to the gateway, you will receive the link that is suitable for the means and methods that you need, you can connect with local and international gateways, and you can select your preferred method.

You can also include a large number of payment methods in your online store, thus encouraging your customers to purchase your products and giving them the freedom to select the method they would like to use.

By using the Fatora website, you do not need to search, arrange and classify. We take care of it, as each item is classified in its place and you can refer to it any time you want.

By registering on the Fatora website, you can collect your money from anywhere, as Fatora provides you with a monthly installment and payment system for monthly products, so you do not need to issue an invoice for each customer at the beginning of every month. You just need to use the subscriptions invoice.

Through this invoice, you will be able to periodically collect payments every month by saving the customers’ card information, and with a click you can cancel the option at any time.

Fatora always endeavors to develop online payment on its application in Qatar by upgrading and improving its services with the assistance of a specialized team and artificial intelligence and financial technology expert.

This application has been very successful and has earned more than 3 million Qatari Riyals, and the number of its users has exceeded 1000 companies as of its launching till this day and is constantly growing.

We, at Fatora, do not only seek the development of our business and the success of our application but also aim to advance the overall digital economy in Qatar and to support and foster its digital payment sectors, in view of prosperity and growth for all and the achievement of secure and easy transactions that keep pace with the contemporary progress.

مختص بالتجارة الإلكترونية، صناعة المنتجات و ريادة الأعمال، تواصل معي ان احتجت لأي مساعدة! #AskWaleed